IMM for Climate Adaptation

An impact measurement and management case study examining the Landscape Resilience Fund’s investment in Koa Impact

Smallholder farmers produce 80% of the food supplied in developing countries. And yet, financial constraints, low crop yields and susceptibility to climate risks negatively affect their livelihoods and food security. Climate-focused impact investing has the potential to alleviate some of these burdens for smallholder farmers. On the positive side, there is a notable increase of 6% of impact capital flowing towards SDG13 - Climate action to combat climate change, with the proportion rising from 40% in 2020 to 46% in 20221.

However, only 10% of climate finance is directed towards climate adaptation – anticipating the adverse effects of climate change and taking appropriate action to prevent or minimise the damage that may arise2. Examples of climate adaptation encompasses initiatives like investing in water-efficient irrigation systems and drought-resistant crops for farmers facing changing water conditions, as well as designing large-scale infrastructures to protect against sea-level rise.

Access to such financing is especially scarce for rural small- and medium-sized enterprises (SMEs) – and virtually none of it comes from the private sector.

This is a key problem that the Landscape Resilience Fund (LRF) seeks to tackle. LRF adopted a unique approach that combines public, private and philanthropic resources to channel investments into climate resilience projects in developing regions, enabling vulnerable people in rural landscapes to effectively adapt to climate change.

Investment strategy

LRF – the investor for impact

The Landscape Resilience Fund is a Swiss independent foundation driven by a deep commitment to support impactful climate adaptation solutions. Created in 2021, this innovative initiative, co-developed by South Pole and the World Wide Fund for Nature (WWF), represents a collaborative effort to address the pressing need for climate adaptation in rural areas.

LRF offers a scalable approach to channelling both private and public climate finance to empower vulnerable smallholders and safeguard landscapes. Initially supported by the Global Environment Facility and championed by a leading luxury brand as anchor investor, LRF is now actively leading a coalition of institutions to invest in building a more resilient future.

These projects focus on reinforcing sustainable agricultural and forestry supply chains, and providing vital protection to smallholder farmers in developing countries.

As stated by its Managing Director, Urs Dieterich, "LRF aspires to have realised tangible outcomes for people and planet – from managing 50,000 hectares of land sustainably, to strengthening the livelihoods of 125,000 people."3

Three levels of impact

The LRF manages the three levels of impact: investee, investor and ecosystem.

At the investee level, which refers to the impact that supported organisations have on people and the planet, LRF directs a substantial portion of its funding towards climate adaptation projects benefitting rural areas.

The investor level refers to the impact that the investor has on the supported organisation. LRF plays an instrumental role in mobilising climate finance and private sector investment for rural SMEs, which are often overlooked by traditional financing mechanisms. Its financial support, which includes grants, loans and equity investments, is supplemented by extensive non-financial assistance through capacity-building and technical support. By providing smaller initial investments to early-stage projects, LRF plays a catalytic role, helping these enterprises establish a track record and attracting further investment.

At the ecosystem level, LRF aims to address the systemic issues of climate adaptation financing. By mobilising finance for climate adaptation initiatives, their approach contributes to more sustainable and resilient supply chains, bridging the funding gap for rural SMEs.

This multi-tiered approach highlights the investor's comprehensive strategy in contributing to the broader goal of sustainable and resilient development in rural landscapes.

IMM strategy

LRF's journey is relatively new (launched 2021), yet the steps taken already offer valuable insights and signal the investor’s commitment to driving meaningful impact.

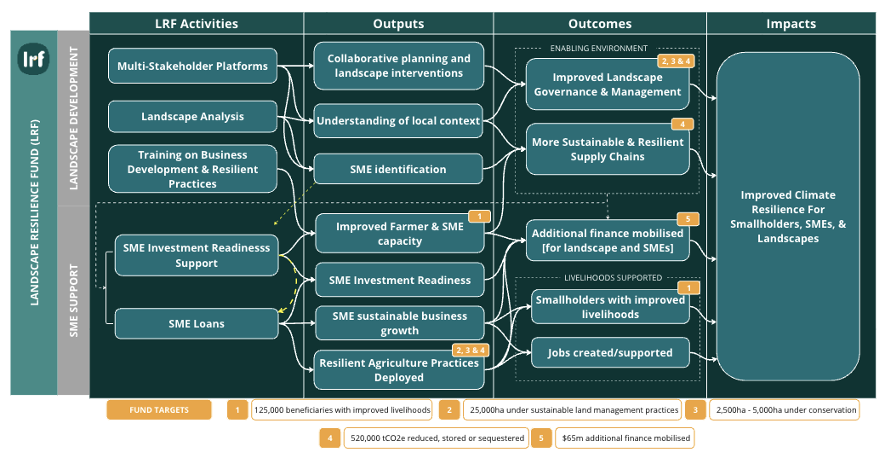

Currently, LRF is crafting an investor theory of change to provide a clear roadmap for their impact-focused initiatives (see below a preview of this work in progress). This theory of change will form the foundation of their IMM governance.

Impact measurement is intricately woven into LRF's decision-making processes. 1.5 full-time employees on this area present impact assessments alongside the commercial aspects, first to the Technical Committee during the screening stage, and later to the Investment Committee after due diligence. This integration ensures that impact considerations are an inherent part of investment decisions.

LRF is constantly improving its science-based resilience and impact framework, designed to ensure that their impact initiatives are firmly rooted in empirical data and evidence. To streamline and standardise their IMM processes, operational guidelines are being developed to serve as a reference to ensure that impact assessments are conducted consistently and effectively. These guidelines and the entire IMM framework will be presented to and approved by LRF's board of trustees, ensuring that impact objectives align with the organisation's strategy. This fosters transparency and accountability.

For efficient impact assessment, the foundation is implementing a clear and structured assessment process, supported by templates that enable consistent data collection and evaluation. Templates offer a standardised approach to assess impact across diverse projects.

LRF meets Koa Impact

When LRF crossed paths with Koa — a Swiss-Ghanaian cocoa innovator that uses cocoa pulp to boost farmer income, reduce food waste and improve climate resilience in the cocoa supply chain — the dynamic was akin to a perfect puzzle coming together.

In 2022, Koa was already a notable presence in the market and was gearing up for an expansion that required additional funding. The SME was expanding upstream, venturing into regions where the raw products originated. This posed risks that made many investors hesitant. However, LRF was not among those who shied away; they saw Koa as an ideal candidate for investment.

Both parties shared a core belief that sustainable development is best achieved by putting the central focus on climate justice and resilience. This is why they both saw keeping agricultural processing within the country and in the rainforest as the way to benefit the most vulnerable stakeholders.

They were also in agreement about how technology can have ripple effects in various sectors. In this case, decentralized mobile solar-powered energy emerged as a game-changer, providing a reliable and renewable energy source to transform the traditional cocoa harvest in rural West Africa, a value chain that did not see any industrialisation for over a century.

Koa's objectives, such as increasing smallholder farmer incomes, resource efficiency and gender-equal employment opportunities in rural communities, perfectly aligned with what LRF sought in its impact-driven investments.

“Koa’s success is based on combining cutting-edge clean technology with local agricultural knowledge in their quest to bring climate-resilient and equitable development to vulnerable Ghanaian landscapes.”

- Urs Dieterich, Managing Director

| Koa's Why | To empower rural communities in West Africa to create significant value to the global food system by applying innovative processes to turn plant-based resources into unique taste experiences & positive impact |

| Koa's How |

|

| Koa's What |

|

After conducting an initial due diligence, LRF identified a minor challenge: the absence of certain elements in Koa's initial impact targets, like living income or wages. However, they quickly resolved this by working together to include additional information and research on how their efforts could help bridge this gap.

In 2022, LRF, along with co-investor IDH Farmfit Fund, made its first investment of USD 2.36 million, allowing Koa to start setting up a new processing facility in Ghana. The facility has the potential to increase production capacity tenfold by 2026 and provide additional income for around 10,000 smallholder farmers.

Main characteristics of the investment:

| Financial instrument & amount | Term loan, USD 2.36 million |

| Time horizon | 6 years |

| Non-financial support | >Support and guidance to design an Environmental and Social Management System and the accompanying deliverables (Child Labour policy, Deforestation policy, Stakeholder Engagement, etc) >Living Income assessment of Koa’s farmers >Support in assessing the opportunity for sourcing from certified farmers (ideally Rainforest Alliance certified4) and/or supporting farmers to get certified >Support provided in the development of a methodology to assess farmer incomes against a living income for how Koa can contribute to and measure farmers’ progress towards receiving a living income (looking at methodologies that exist already). >Connecting Koa to local stakeholders in the Kakum landscape and supporting them to strengthen their local engagement through our landscape approach |

| Co-investors | The IDH Farmfit Fund |

Mission and impact align

LRF significantly contributed to refining and enhancing the investee's initial impact framework. Before their collaboration with Koa, the company had already established a robust environmental and social impact framework, later implemented in this particular investment. Koa's key impact areas encompassed farmer income, gender pay equity, community development, energy and water management, conservation of natural resources, resilience and waste management.

What made this partnership remarkable is the close alignment between Koa's existing impact framework and the objectives and impact indicators endorsed by LRF and co-investor IDH Farmfit Fund. Their shared commitment to these indicators facilitated a swift collaboration, requiring only minor adjustments to the list of monitored indicators.

In a collaborative effort, LRF worked closely with Koa's team to reach a shared understanding of these additional indicators. This collaboration ensured that the impact framework became comprehensive, aligning perfectly with investor expectations while reflecting Koa's mission and activities.

Identifying stakeholders

In the collaborative journey between LRF and Koa, the process of identifying and understanding stakeholders was fundamental. It allowed both the investor and investee to gain a comprehensive understanding of the interests, potential influence and consequences associated with each stakeholder group.

Koa’s Stakeholder Identification Plan involved a deep analysis of various stakeholder groups, examining their interests, the extent to which they could be affected and the potential influence on Koa's business activities. They identified:

1. Directly and indirectly affected stakeholders

This category encapsulated those communities at the periphery of Koa's projects and operations, but were still subject to their influence. It included adjoining land users and prior landowners.

2. Stakeholders with interest and influence

Parties who wielded both interest and varying levels of influence over Koa's projects and operations. This included entities like the Environmental Protection Agency Ghana, the Water Resources Commission, traditional authorities and youth groups.

3. Beneficiary stakeholders

Stakeholders who directly reaped the rewards of Koa's projects and operations, comprising cocoa farmers and cocoa farming communities, who experience positive outcomes from the enterprise's interventions.

“Throughout our journey, our investment in an innovative SME such as Koa, that empowers smallholders, has not only generated financial returns but also strengthen the resilience of communities and cocoa smallholders. [When] we exit this phase, I'm proud to say that our commitment to creating lasting positive impact remains unwavering. The advancements we've witnessed in smart-agricultural practices, income diversification, and access to essential resources among these smallholders underscore the potential for profitable, sustainable, and socially responsible investments. While this chapter may close, the legacy of enhanced livelihoods and strengthened communities endures, inspiring us to continue championing investments that align profitability with lasting change.”

– Marie-Andrée Liere, Adaptation and Impact Management at LRF

Risks & management

“The greatest obstacle we face is time. Undertaking a project of this magnitude involves coordinating resources from various locations around the world, which poses significant challenges. Moreover, unpredictable weather conditions can disrupt transportation and construction, further complicating matters. These factors have forced the entire team to adapt our plans, but we have managed to overcome most of these challenges. Through this process, we have gained invaluable knowledge and experience, and now we find ourselves on the final stretch towards successfully completing the project.” – Alejandro Jiménez Ospina, Technology & Technical Procurement Manager at Koa, sharing his view on the construction of Koa’s newest cocoa fruit factory in the Eastern Region of Ghana.

Investee level risk

Enterprises like Koa inherently bring immediate financial and project risks that would deter most investors. The geography in which they operate, often characterised by complex supply chains in remote or underdeveloped regions, can lead to logistical and operational challenges; the sector itself is frequently exposed to uncertainties related to weather patterns, commodity prices and market demand; and the maturity of the ecosystem varies widely, with some regions lacking critical infrastructure or regulatory frameworks, increasing the project's exposure to unforeseen events.

To address this, LRF established a meticulous system to identify, assess and address these risks: the Environmental and Social Management System. Drawing inspiration from international best practices, including guidance from the renowned IFC Performance Standards, LRF initiated the assessment of the impact risks that Koa's venture could encounter.

After an initial desk-research phase, LRF ventured beyond office walls during the due diligence process to validate initial risk assessments. One of the most significant and immediate risks was Koa's operation in the cocoa value chain, which carried immediate concerns about child labour and deforestation. Field visits provided direct insights and tapped into Ghana's whistleblower system, where child labour sightings are reported (this system is part of a broader multi-stakeholder initiative led by the International Cocoa Initiative, the Child Labour Monitoring and Remediation , whose goal is to end child labour in the cocoa supply chain).

LRF played an active role in formalising a comprehensive action plan, emphasising Koa's commitment to refrain from any involvement in deforestation or child labour. Investor and investee laid out a specific set of deliverables linked to disbursements; Koa’s failure to comply with these deliverables would lead to disbursement withholding.

This plan was integrated into the Environmental and Social Action Plan, serving as a formalised framework and safeguard for all stakeholders involved. The plan, a cornerstone of LRF's risk management strategy, provided a detailed timetable and outlined the required activities to ensure Koa's operations fully adhered to the Environmental and Social Management System standards. This process was initiated after the due diligence phase, marking a prerequisite for any grant or loan disbursement. The Environmental and Social Action Plan covered a period of up to one year before investment, and up to two years after the investment's initiation.

In addition to immediate risks, LRF acknowledged the potential impact of long-term challenges. To address this, they created a Risk Management Plan, which guided risk management throughout the investment's life cycle. Long-term risks encompassed factors like deforestation, which was proactively approached by identifying susceptible regions that could affect cocoa production and supply chain resilience, building a proactive community engagement adhered to deforestation-free practices and cocoa certification standards.

Investor level risk

LRF was not immune to its own set of challenges, and devised a comprehensive list along with their mitigation strategies:

Risk 1: Regulatory & Political

Investments could be influenced by regulatory changes, political instability and policy shifts.

Mitigation: LRF remained informed about the regulatory environment, the political landscape and potential policy changes in the investment's jurisdiction, alongside diversifying their investments across various regions.

Risk 2: Environmental & Social

Investments intended to create positive social or environmental impact might inadvertently lead to negative consequences if not managed properly.

Mitigation: Conducting thorough social and environmental due diligence, adhering to best practices and standards and monitoring for any unintended negative effects can mitigate these risks. The Environmental and Social Action Plan served as a structured framework to ensure compliance with Environmental and Social Management System requirements, with a comprehensive timetable covering a year pre-investment and two years post-investment

Risk 3: Reputation

Risk of damaging their reputation loomed if Koa's investment failed to deliver the intended positive outcomes

Mitigation: Setting realistic impact expectations, transparently communicating progress and challenges, and actively engaging with stakeholders can help manage reputation risk.

Risk 4: Scalability & Replicability

Struggle to scale up or replicate their success in different contexts

Mitigation: Investing in initiatives with clear scalability plans, involving stakeholders in the design phase and identifying potential barriers to replication.

Over time, LRF's approach to risk tolerance adapted as they engaged with various SMEs. They understood that flexibility was vital, particularly when imposing requirements during the due diligence process, acknowledging that not all businesses possessed the necessary resources to meet every criterion.

Selection of indicators

LRF and Koa worked together to identify the baseline, set targets and develop a comprehensive framework for assessing their impact. This framework included the scale of change, its depth and duration of outcomes.

The indicators displayed below are a work in progress, and the procedure for setting thresholds and targets is still ongoing.

Identifying the baseline

Koa already had some baseline indicators in place, many of which were already under regular tracking. These pre-existing baselines served as the foundation upon which the measurement of impact and the tracking of progress would be constructed. However, LRF and Koa completed a new survey in the last quarter of 2023 that will serve as a baseline for the indicators that Koa had not tracked until the investment. The new survey is particularly focused on the areas where Koa is expanding its operations.

Setting targets & thresholds

The targets were set based on the six-year duration of the loan and Koa's own impact targets. Projections for this period played a pivotal role in defining these targets.

Importantly, LRF adopts a flexible stance when Koa falls short of the agreed-upon targets or thresholds. In such instances, LRF engages with the enterprise to understand the underlying reasons for this deviation and how they are actively addressing it. While meeting key performance indicators (KPIs) remains essential, external factors that hinder target attainment are considered. As long as Koa demonstrates a backup plan and a strategic approach to counteract these challenges, LRF maintains flexibility by either adjusting the timelines to meet KPIs or working on a new plan to reach them.

Business performance targets

For Koa's business performance, the envisioned outcomes were ambitious. LRF expected Koa's revenues to grow significantly by a CAGR of 55% within a span of three years on the back of the increased production capacities from the new processing facility. Additionally, they aimed to catalyse 3 dollars for each dollar invested by the LRF, reflecting not only financial growth but also the ability to attract external investments to further grow Koa’s impact.

Impact monitoring

LRF’s team monitors and supports Koa and its impact indicators, essential signposts on the enterprise's transformative journey. Currently, Koa follows a structured reporting calendar, offering updates on an annual and quarterly basis.

Additionally, Koa diligently complies with various reporting requirements, ensuring transparency and accountability. They include on their reporting checklist:

- General progress and milestones

- Reporting on KPIs

- Reporting on Environmental and Social Action Plan progress6

- Reporting on Development Action Plan progress .

- Risk reporting

- Financial reporting

- Proof of progress (documents that serve as evidence of progress reached)

- Letter of Representation, to be signed by management with every quarterly update

Koa's impact reporting is not a solitary journey. They share their progress and outcomes with LRF and IDH Farmfit Fund, both being lenders who have a vested interest in their success. This collaboration ensures that the enterprise aligns its reporting requirements with both funds, mitigating the reporting burden and streamlining the process. Together, LRF and IDH have established a set of common KPIs and requirements that apply to both, fostering a unified approach to impact transparency.

Koa also shares these updates with other stakeholders, including their board and past investors.

Capturing impact holistically

To gauge the impact comprehensively, LRF gathered quantitative and qualitative data. Quantitative metrics included the number of smallholders reached and products distributed, while qualitative ones focused on the quantity and content of training provided.

Due diligence in the field also played a crucial role. Direct interactions with smallholders and their families revealed invaluable insights into the profound and lasting changes brought about by Koa's presence.

Additionally, Koa collected feedback. Given their existing surveys and workshops with smallholders, Koa took the lead in fostering a direct and participatory relationship with them, ensuring their voices were heard and their experiences informed the ongoing impact journey.

Verifying impact

At the portfolio level, LRF has been advocating for a landscape approach, which encourages investees to work closely with all relevant stakeholders, including beneficiaries. This collaborative method ensures they play a central, vocal role in the impact valuation process.

From the outset, Koa embraced this approach and prioritised feedback from smallholder farmers in their decision-making processes. They collaborated with local leaders and maintained a dedicated local team with deep contextual understanding.

An example is the testimony of Sadiq Ashietu, who joined Koa farmers this year. She is now able to pay her labourers on time and support her children better in school. She even opened her own shop.

“Regarding our cocoa,” said Sadiq, “we noticed less theft cases since we harvest, break and send them to Koa for processing as we get them delivered home for further processing. Now we have much more control over our beans than before.”

Up until today, Koa continuously refines its strategy and activities by listening to and acting upon feedback like Sadiq’s, ensuring that the mission of creating meaningful and lasting changes in the lives of cocoa farmers and their communities is upheld.

In this journey, a key revelation is the absence of a trade-off between impact and profits. In other words, Koa’s business model follows a lockstep model. This is especially helpful for accessing more capital: focusing on the impact story, along with additional indicators required by lenders, contributed to Koa's ability to fundraise and expand.

Transparency & reporting

Koa’s reporting facilitates LRF's reporting to various stakeholders, including their anchor investor, Swiss Authorities, and the Global Environment Facility (GEF). It allows LRF to present clear progress on impact and contributions to their fund KPIs, fostering transparency and accountability.

Rigorous due diligence, engaging with company management, advocating for enhanced disclosure requirements and supporting best practices in corporate governance and sustainability are just some of LRF’s strategies to foster transparency.

Opportunities lie in long-term value creation, sustainability, innovation and regulatory evolution, which promote greater transparency and adherence to ESG factors. However, barriers such as a lack of standardisation in reporting formats and information asymmetry between enterprises and investors persist. Up until today, LRF encounters challenges in measuring the impact of various SMEs operating across diverse locations, value chains and activities with smallholders. Standardising impact assessment is a complex task, given the unique nature of each investee. Moreover, they often grapple with limited resources and expertise, making it challenging to meet robust reporting requirements.

LRF addresses these issues by adopting a flexible approach, offering support to alleviate the reporting burden on SMEs and ensuring that reporting requirements are manageable. Having learned directly from its investment in Koa, complex reporting demands add to the challenge, as SMEs may struggle with the intricacies of financial statements, performance metrics, regulatory compliance and risk assessments.

Long-term sustainability for Koa

As LRF embarks on an exit from their 6-year loan, their commitment to preserving impact and fostering long-term financial sustainability for Koa remains resolute. This involves diligent monitoring and strategic integration of impact indicators into Koa’s core business model. Quarterly and annual reporting serve as vital tools to ensure that Koa's impact continues well beyond the investment period.

Furthermore, LRF strives to make the additional KPIs introduced during the investment period a permanent part of Koa's tracking and reporting system. These indicators should help Koa achieve a greater impact, facilitate internal record-keeping, and present quantitative data for potential investors and fundraising purposes.

Next steps

Under the co-lead of its Production & Operations Director, Daniel Otu, and Finance Director, Francis Appiagyei-Poku, Koa aspires to expand their positive impact across new cocoa-growing regions in Ghana. LRF's investment has allowed them to leverage previously discarded cocoa pulp to boost and diversify smallholder farmers' income, expecting to create additional income for over 10,000 cocoa farmers. Furthermore, the new production plant will create 250 jobs and new vocational opportunities for communities in rural Ghana.

If Koa can become financially sustainable, thanks to LRF’s investment and their rigorous attention to impact measurement and management, this development can serve as a sign for others seeking to address a system in crisis. SMEs like Koa will not be able to effectively adapt to climate change without investors who fully understand the scope of this problem. The financial needs for climate adaptation in developing countries are reported to be 10-18 times larger than international public finance flows, which exceeds the previous estimates by over 50 percent7 . The gap between the pressing need to protect communities from extreme climate events and the current mitigation efforts is only increasing.

Farmers see the gap in their cocoa yields and their livelihoods. LRF sees the gap in the system – and seeks, in investments like this, to bridge it. Furthermore, the lessons learnt in impact measurement and management from this case leave LRF well poised to optimise their next climate adaptation investments.

__

1Gaggiotti, G., Gianoncielli, A., Accelerating Impact (2022). Impact Europe.

2 What is the difference between climate adaptation and mitigation? (n.d.). European Environment Agency.

3Building a space where finance and nature meet. (2022). Global Environment Facility.

4Being Rainforest Alliance certified means a product respects the three pillars of sustainability: social, economic, and environmental. (2023). Rainforest Alliance.

5The Child and Labour Monitoring and Remediation initiative focuses on developing predictive models and subsequent target interventions for child labour in African cocoa-growing areas. Learn more

6The Development Action Plan (DAP) is a similar document to the Environmental and Social Action Plan (ESAP), yet it is not legally binding. This Development Action Plan (DAP) is derived from the findings and assessment against the LRF's relevant Environmental, Social and Governance Guidelines and Environmental and Social Management System (ESMS). The actions defined in this report address mainly outstanding impact maximisation opportunities of the Borrower (Koa) in proportion to Koa’s activity type, scale, and location.

7 Adaptation Gap Report 2023 (2023). UN.

__

Partners: